Tarku’s Generates 5.35km of Targets for Drilling its 3As Projects, Quebec

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

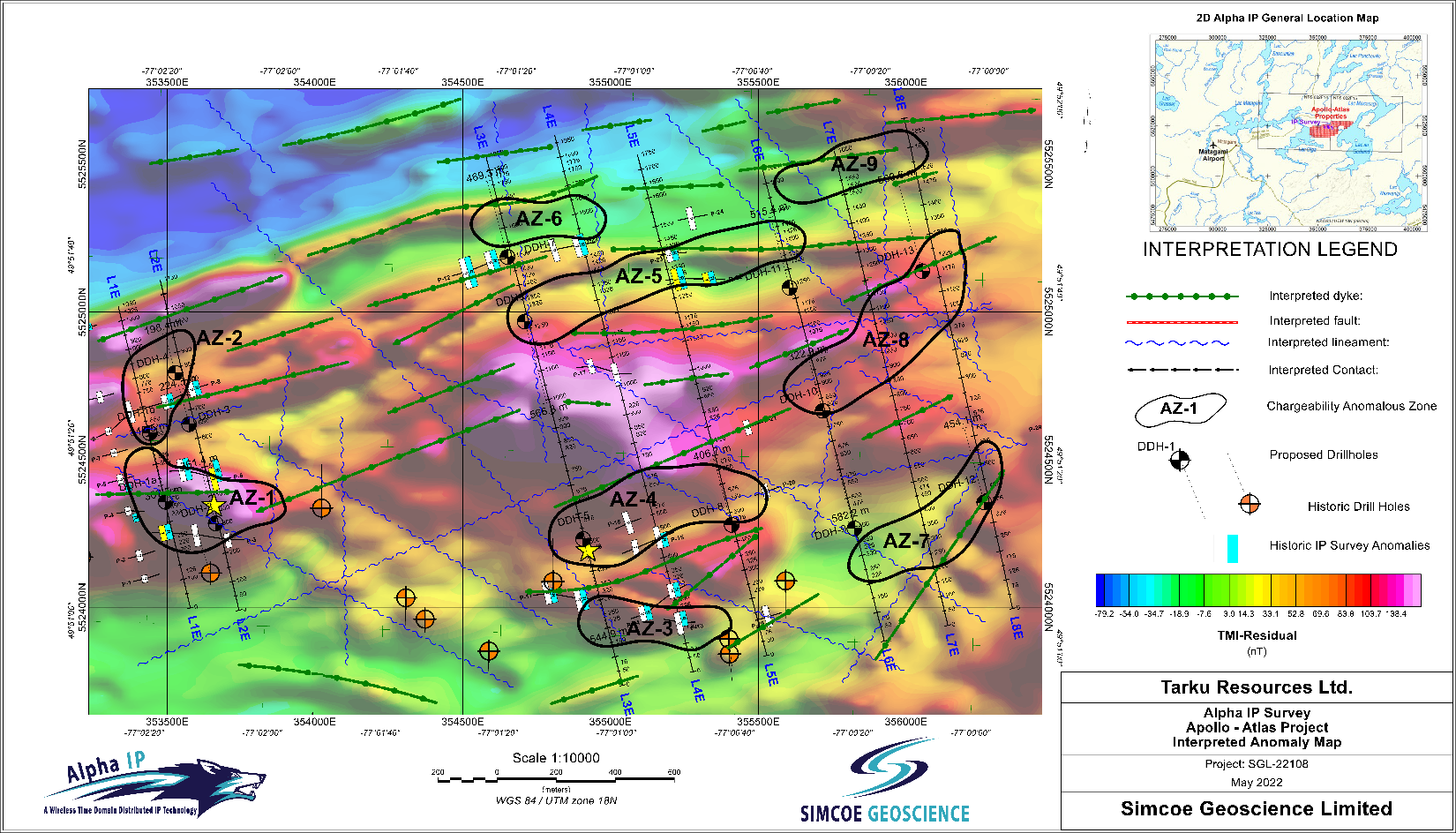

MONTREAL, May 26, 2022. Tarku Resources Ltd (TSX-V: TKU – FRA: 7TK – OTCQB: TRKUF) (the “Company” or “Tarku”) is pleased to announce that nine high-priority targets, totalling 5.35km in length, have been generated ahead of the maiden drill program at the Apollo Gold Project, following the completion and interpretation of the deep-penetrating and high-resolution IP survey. Apollo is located in the Matagami area, Eeyou Istchee James Bay, Quebec.

- Nine (9) high-priority Target Zones, covering a total strike length of 5.35km generated by independent consultant

- Targets are located on chargeable anomalous zones

- Two of these Targets, AZ-1 and AZ-4, are located on known gold occurrences defined by historic drilling

- Historic drilling was on the edge of these anomalies and failed to test the most prospective areas

- Individual targets vary in length from 400 meter to 1,000 meters

- Independent consultant has proposed 13 drill holes over these nine targets

- Drilling to commence in the Fall of 2022

Julien Davy, President and CEO of Tarku Resources said: “This is an exciting time for Tarku and our shareholders, the scale and number of the targets generated by this work program at the Apollo Project has surpassed all our expectations. We will now refine the proposed drill holes ahead of commencing a maiden drill programme at the 3As Projects.”

The IP Survey Interpretation:

The 14.5-line km survey has been conducted by Simcoe Geoscience, using their Alpha IPTM system. Eight (8) lines were completed in 22 working days over the priority area of the Rivière Waswanipi Shear Zone, which Tarku interprets as being the east extension the regional Sunday Lake Fault, host of the Detour Lake Gold Mine or the Kirkland Lake Gold Mining Camp. The results of this Induced Polarization (IP) survey were combined with the existing IP and magnetic data to ensure the maximum amount of information could be used in the targeting process for our maiden drill program at the 3As Projects.

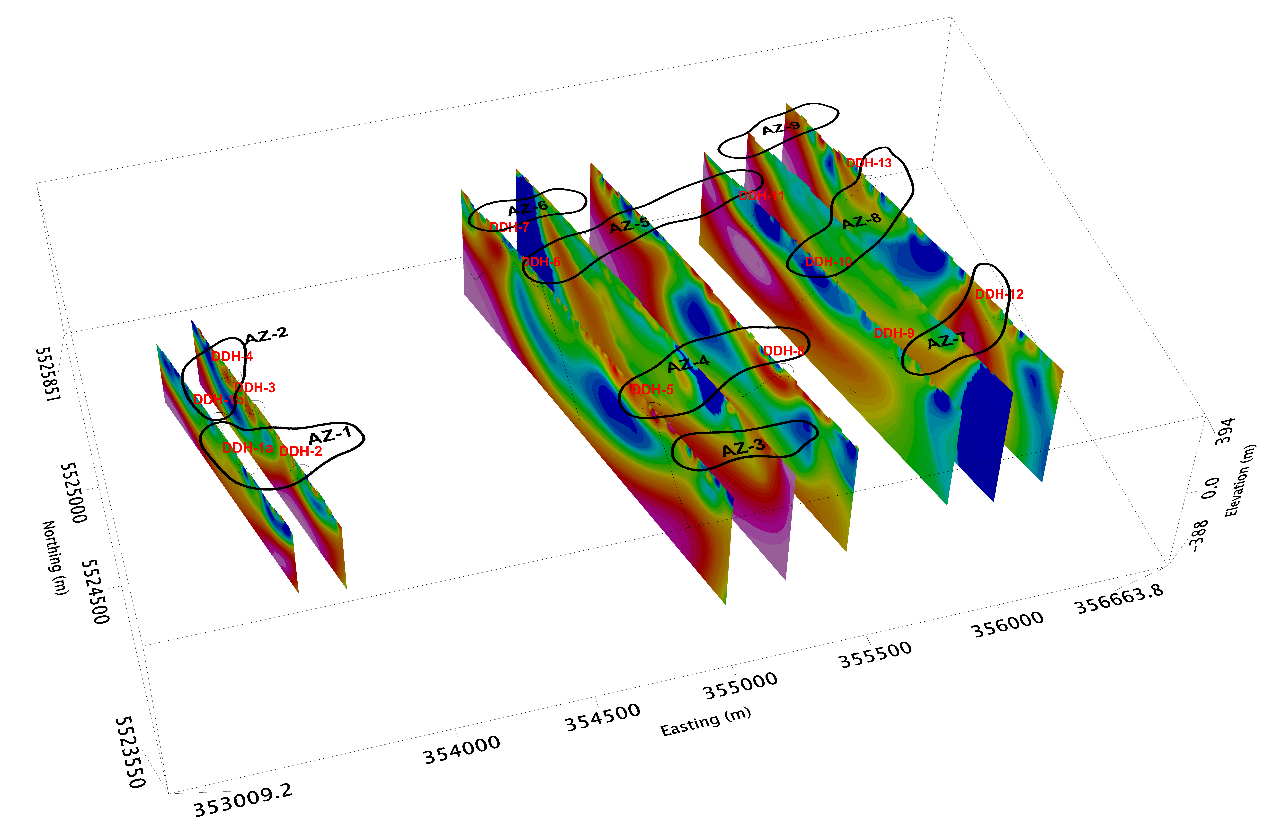

The resistivity data has defined a number of local structures and geological features, including a series of ENE-WSW dykes and NW-SE oriented faults. The chargeability data has defined nine areas of potential sulphide mineralization covering a total strike length of 5.35km, that appear to be associated with these the dykes and faults (Figure 1). These targets are near-surface, up to 400 meters below the surface (Figure 2).

The targets generated fall into two broad groups:

Strong IP responses associated with low/moderate resistivity values. The responses in this group are interpreted to be consistent with sulphide mineralization, usually offset from structures. The anomalies in this group are potentially associated with gold mineralization hosted by porphyritic and alkaline rocks at the edge of magnetic highs.

Strong IP responses associated with high/moderate resistivity values. The responses in this group are interpreted to be consistent with gold mineralization within shear zones and porphyritic dykes bearing anomalous gold values

Figure 1: Anomaly Interpretation Map over the Apollo Project with Proposed Drill Holes

Figure 2: Chargeability Anomalies at the Apollo Project with Proposed Drill Holes

About the 3As project

The Apollo Project is part of the 100%-owned by Tarku 3As project (Apollo, Atlas, Admiral) and is located adjacent and to the north of its Atlas Project. It consists of 69 claims (3,775 ha) centred on the Rivière Waswanipi ductile shear zone. This regional structure is characterized by the presence of alkaline rocks, polygenic conglomerates (Timiskaming type) and porphyry intrusions bearing anomalous gold values on the order of hundreds of parts per billion (GM 52712). This corridor, altered to carbonate-hematite-magnetite, contains the Rivière Waswanipi gold showing (2.36 g/t Au over 1 m; GM 51193) hosted in a porphyritic dyke and tuffs altered to pyrite-fuchsite, as well as several porphyry intrusions bearing anomalous gold values on the order of 0.1 to 0.9 g/t Au over 0.6 to 5 m (GM 52712).

Collectively, these metallotects present a favourable setting for orogenic gold mineralization associated with alkaline rocks and porphyry intrusions, which Tarku interprets as being similar to those of the regional Sunday Lake Fault, host of the Detour Lake mine or the Kirkland Lake Mining Camp. Tarku cautions that the mineralization at the Detour Lake mine or the Kirkland Lake mining Camp may not be indicative of the mineralization that may be identified on the Company’s Matagami projects and is used as a conceptual exploration model only.

Qualified persons

Julien Davy, P.Geo., M.Sc, MBA, President and Chief Executive Officer of Tarku, the qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, prepared, supervised and approved the technical information in this news release.

About Tarku Resources Ltd. (TSX.V: TKU – FRA: 7TK – OTCBQ: TRKUF)

Tarku is an exploration company focused on new discoveries in favourable mining jurisdictions such as Quebec and Arizona.

In Arizona, within the famous Tombstone District, Tarku owns 100% of the 29 km2 Silver Strike Project. Silver Strike has been interpreted by management to have the protentional for similar CRD Deposits comparable to the Hermosa Project, located 80km west in Santa Cruz County, Arizona, which South32 acquired for USD 1.8 billion in 2018. Tarku is currently planning a deep-penetrating and high-resolution geophysical survey over the priority targets, with a minimum of 5,000-meter drill program to follow this year.

In Quebec, Tarku owns 100% of the “Three A’s” exploration projects, (Apollo, Admiral and Atlas Projects), in the Matagami Greenstone Belt, which has been interpreted by management as the eastern extension of the Detour Belt. The Detour Belt has seen recent exploration successes by Midland Exploration Inc., Wallbridge Mining Company Ltd., Probe Metals Inc. Tarku has now commenced a deep-penetration and high-definition IP geophysical survey over priority area on Atlas and Apollo Projects, and a minimum of 3,000-meter drill program is planned to follow this during 2022.

On behalf of Tarku Resources Ltd

Julien Davy,

President and CEO

Tarku Contact Information:

Email:

Website: www.tarkuresources.com

Please follow @TarkuResources on LinkedIn, Facebook, Twitter and Instagram.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku’s periodic reports including the annual report or in the filings made by Tarku from time to time with securities regulatory authorities.