Tarku acquires 100% of the MAX Lithium property

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

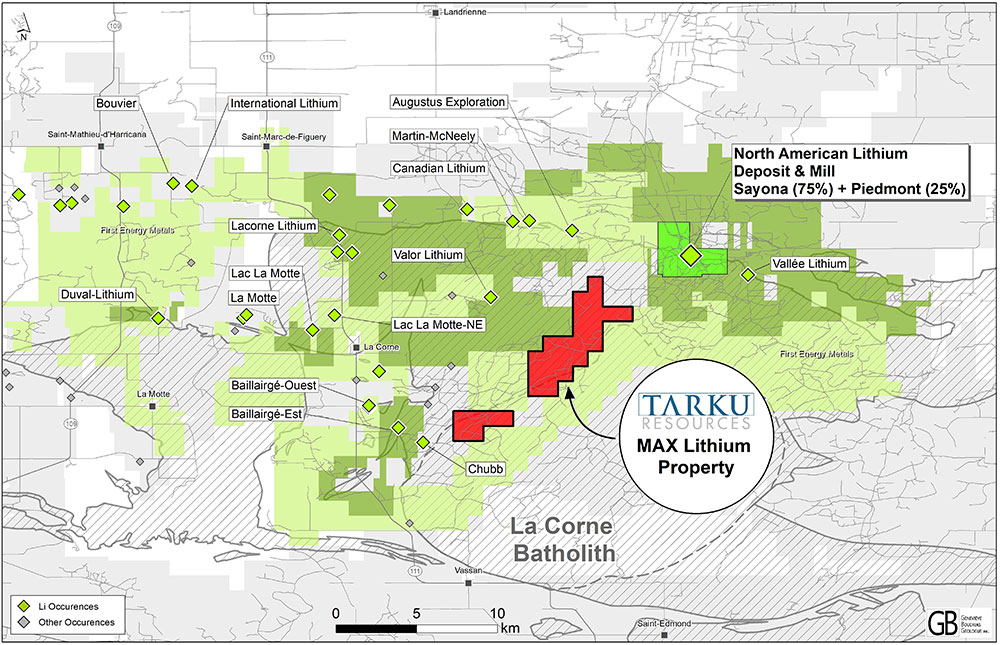

- MAX Lithium property located in same batholith and geology as and just 4 km southwest of the North American Lithium mine, the only operating lithium mine in Quebec

- 19 km2 property with road access, surrounded by spodumene-rich pegmatite showings and hosting several outcrops with as-yet untested potential

- Exploration program to commence soon, and will include detailed mapping and sampling to prepare next drill targets

MONTREAL, March 1, 2023. Tarku Resources Ltd (TSXV: TKU | FRA: 7TK | OTCQB: TRKUF) (the “Company” or “Tarku”) is pleased to announce the acquisition of a 100% interest in 28 claims (19.25 km2) forming the MAX Lithium property from prospectors (the “Vendors”). The property is located in Quebec, Canada, 45 km north of Val-d’Or and 4 km southwest of Sayona Mining’s North American Lithium mine (proven reserves of 1.2 million tonnes grading 0.92% Li2O and probable reserves 28 million tonnes grading 0.96% Li2O (source: company press release dated May 23, 2022)).

Julien Davy, President and CEO of Tarku Resources, said: “This agreement presents a significant new opportunity for Tarku shareholders in the growing global lithium market. Quebec is a haven for high-grade, high-quality lithium, and this project has the advantage of being located on the same batholith and geological context as the only producing lithium mine in Quebec, with spodumene-rich pegmatite showings surrounding the property. The other interesting fact about this property is that it seems to have been overlooked by past explorers, despite its prime location. We intend to do aggressive exploration and drill the project as soon as possible.”

“This new lithium project is also a good complement to our portfolio of quality gold and silver assets in Quebec and Arizona, where we’ll continue to be very active this year, and fits with Tarku’s established exploration strategy of exploring in overlooked, easily accessible areas with strong geological potential in safe jurisdictions,” added Mr. Davy.

Summary of the transaction to acquire the MAX Lithium property

Tarku can earn a 100% interest in the MAX Lithium property by issuing 4 million common shares of the Company (including escrow provisions to release one quarter of the shares in 4 months, one quarter in 8 months, one quarter in 12 months and the final quarter in 16 months). The Company will file all requisite documents with the TSX Venture Exchange (the “TSXV”) in connection with this transaction in order to obtain final acceptance.

Location of the Max Lithium property

Figure 1: Location of Tarku’s MAX Lithium property within the La Corne batholith at 4 km from North American Lithium’s operations

Update on other key projects

The Company also remains active on its other key projects.

On its wholly-owned Silver Strike project in Arizona, Tarku conducted a geophysical survey in 2022 and is now finalizing the planning of its 2023 exploration program, which will include surface mapping over the new targets generated, and potential drill program depending on market conditions. The MAG data from the 2022 survey was the first recent geophysical data for the area and has been used successfully in the discovery of carbonate replacement deposits (CRD), Tarku’s target at Silver Strike.

In Quebec, on its wholly-owned Apollo Gold project, Tarku has completed a maiden 3,048-metre drilling program over the extension of the Sunday Lake fault. Visual inspection of the core reveals both intensive hydrothermal alterations, similar in style to orogenic gold deposits, and magmatic alterations, including hematization, carbonatization and sericitization associated with fine-grained disseminated pyrite, pyrrhotite, sphalerite and copper observed over intervals up to 45 metres thick. Assay results are still pending but are expected very soon.

Financing announcement

Tarku also announces that it is undertaking a non-brokered private placement of units of up to $280,000.

Pursuant to the placement of units, Tarku is offering up to 4,000,000 units (the “Units”) at a price of $0.07 per Unit. Each Unit consists of one common share and one share purchase warrant entitling the holder to acquire one additional common share in the capital of the Company at a price of $0.12 per share, for a period of 24 months from the date the Units are issued. The proceeds of the financing will be used for general working capital purposes.

The Company will file all requisite documents with the TSX Venture Exchange in connection with this transaction in order to obtain final acceptance.

Stock option grant

The board of directors has approved the grant of 3,440,000 stock options pursuant to the Company’s stock option plan. The options were granted to directors, officers and consultants of the Company and are exercisable at a price of $0.10 per share. If not exercised, they will expire on February 28, 2027, subject to earlier expiration in accordance with the stock option plan and the applicable policies of the TSX Venture Exchange.

Qualified persons

Julien Davy, P.Geo., M.Sc, MBA, President and Chief Executive Officer of Tarku, a qualified person under National Instrument 43-101 on standards of disclosure for mineral projects, has prepared, supervised and approved the technical information in this news release.

About Tarku

Tarku Resources Ltd. (TSXV: TKU | FRA: 7TK | OTCBQ: TRKUF) is a mining exploration company focused on advancing the development of new discoveries by using modern techniques in favourable mining jurisdictions such as Quebec and Arizona.

In Arizona, within the famous Tombstone District, Tarku owns 100% of the 29 km2 Silver Strike project. Silver Strike has been interpreted by management to have the potential for similar Carbonate Replacement Deposits (CRD) comparable to the Hermosa project, located 80 km west in Santa Cruz County, Arizona, which South32 acquired for USD 1.8 billion in 2018.

In Quebec, Tarku owns 100% of the “Three A’s” exploration projects, (Apollo, Admiral and Atlas projects), in the Matagami Greenstone Belt, interpreted by management as the eastern extension of the Detour Belt, which has seen recent exploration successes by Midland Exploration, Wallbridge Mining Company and Probe Metals. In addition, the Company owns the MAX Lithium project, located 4 km southwest of Sayona Mining’s North American Lithium mine.

On behalf of Tarku Resources Ltd

Julien Davy,

President and CEO

Tarku Contact Information:

Email:

Website: www.tarkuresources.com

Please follow @TarkuResources on LinkedIn, Facebook, Twitter and Instagram.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku’s periodic reports including the annual report or in the filings made by Tarku from time to time with securities regulatory authorities.