Tarku Acquires the Nickel, Copper Dana Project, Quebec

MONTREAL, May 14, 2024. Tarku Resources Ltd (TSXV: TKU; OTCQB: TRKUF; FRANKFURT: 7TK) (the “Company” or “Tarku”) has acquired the Dana Project, a nickel, copper, cobalt, and PGE project, located in Quebec. The Company continues to focus on its flagship projects, including the Three A’s in Quebec and its Silver Strike Project in Arizona but believes the staking of the Dana Project adds significant longer-term value to the company at a minimal cost.

Julien Davy, President and CEO of Tarku Resources, commented “the undervalued nature of exploration companies, relative to metal prices, and the restricted environment for raising capital create many valuable opportunities to gain interests in excellent projects that would otherwise be secured. While we are continuing to focus on our two core projects, adding strategic projects like Dana to the company’s portfolio will add significant value in the longer term.”

The Dana Project, Quebec (copper, nickel, cobalt, PGEs)

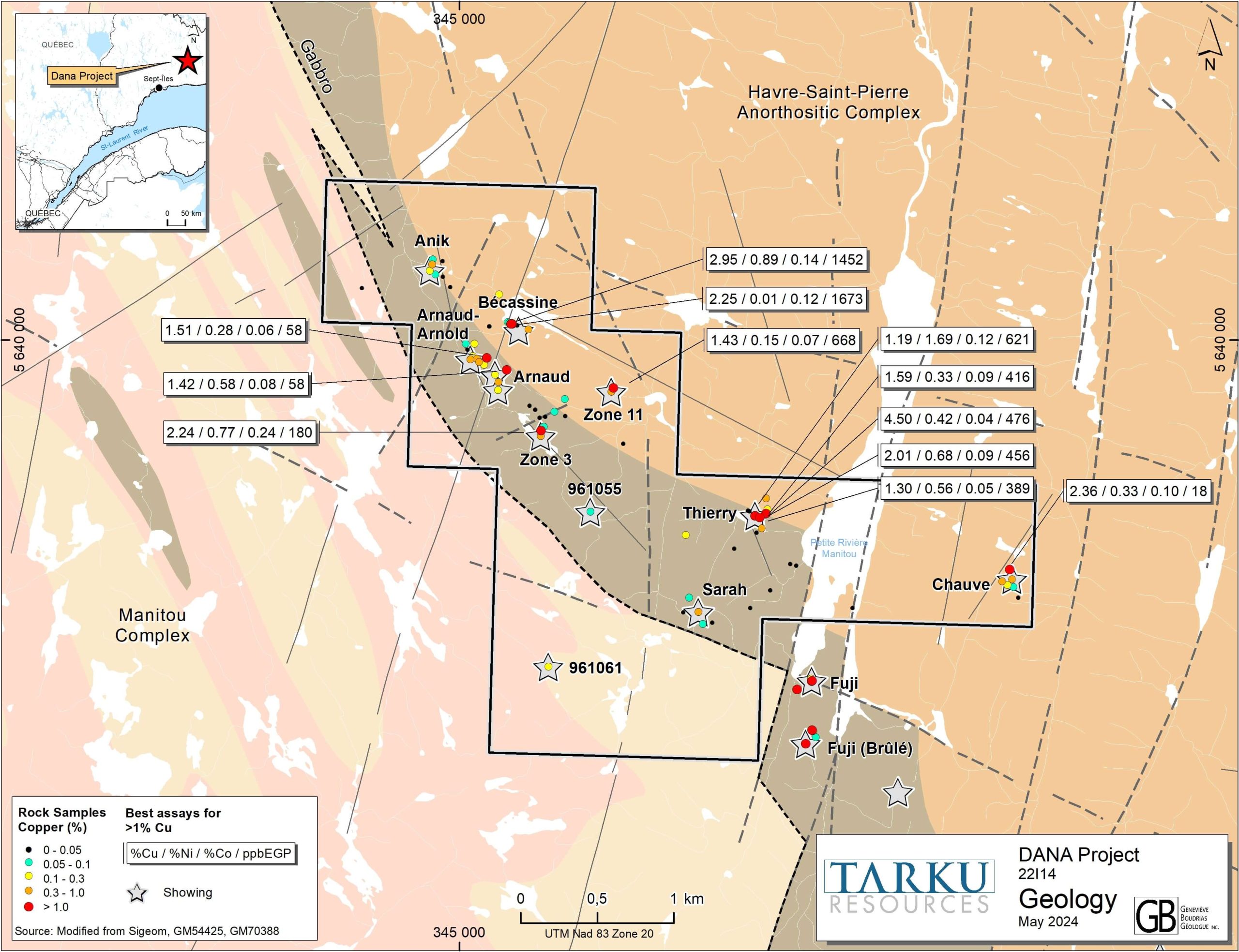

Recently acquired through staking, these mining titles located near Lake Manitou, Côte-Nord, Quebec (NTS sheet: 22I14), straddle the border of the well-known Havre-Saint-Pierre (“HSP”) anorthosite complex. The HSP complex is home to the Lac Tio Titanium mine of Rio Tinto, as well as numerous other vanadium, titanium, iron, copper, nickel, cobalt, platinum-group elements (PGEs), and Rare Earth (REE) deposits and showings. Locally, the area is known to contain Ni-Cu (±Co ±PGE) magmatic massive sulfide (MMS) mineralization, and Dana contains several historical surface showings that returned high-grade polymetallic mineralization, including:

4.50% Cu, 1.69% Ni, 0.09% Co and 537 ppb PGE (showing Thierry)

2.36% Cu, 0.37% Ni and 0.10% Co (showing Chauve)

2.84% Cu, 0.53% Ni, 0.12% Co and 1 452 ppb PGE (showing Becassine)

The last work programme completed on the property was in 2017, to follow up on historical showings and a series of EM anomalies. The Grenville Province is known for hosting magmatic Ni-Cu (±Co ±PGE) mineralization at convergent margins, with recent studies highlighting the significance of multi-stage reworking and recycling of sulfide liquid in long-lived magmatic systems for ore genesis (Barnes and Robertson, 2019).

Recent studies have also shown that the probability of finding a Ni-Cu deposit in a Grenvillian environment is strongly correlated with the volume of mafic rocks contained in an intrusion. This correlation is evident at Dana, where a substantial volume of gabbro has been identified to host Ni-Cu occurrences. Despite the significant role faults play in the formation of this type of deposit, they have remained underexplored on the property.

Tarku’s management is confident that the Dana property possesses all the essential elements — drivers, sources, pathways, and traps — to potentially host a magmatic Ni-Cu (±Co ±PGE) deposit. Currently, Tarku is consolidating existing geological information of the Dana area in preparation for an upcoming exploration work program.

The Dana project contains several copper and nickel showings with known values up to 4.5% Cu, 1.69% Ni, and up to 0.47% Co.

Qualified persons

Julien Davy, P.Geo., M.Sc, MBA, President and Chief Executive Officer of Tarku, a qualified person under National Instrument 43-101 on standards of disclosure for mineral projects, has prepared, supervised and approved the technical information in this news release.

About Tarku

Tarku Resources Ltd. (TSXV: TKU; OTCQB: TRKUF; FRANKFURT: 7TK) is a mining exploration company focused on advancing the development of new discoveries by using modern techniques in favourable mining jurisdictions such as Quebec and Arizona.

In Arizona, within the famous Tombstone District, Tarku owns 100% of the 29 km2 Silver Strike project. Silver Strike has been interpreted by management to have the potential for similar Carbonate Replacement Deposits (CRD) comparable to those of the Hermosa project, located 80 km west, in Santa Cruz County, Arizona, which South32 acquired for USD 1.8 billion in 2018.

In Quebec, Tarku owns 100% of the “Three A’s” exploration projects (Apollo, Admiral and Atlas) in the Matagami Greenstone Belt, interpreted by management as the eastern extension of the Detour Belt, which has seen recent exploration successes by Midland Exploration, Wallbridge Mining Company and Probe Metals.

Additionally, Tarku maintains its exploration efforts across its other 100% owned projects in Quebec, strategically located along regional shear zones and areas with known mineralization in gold, copper, zinc, nickel, or lithium. This comprehensive approach reaffirms the company’s strategy to delineate and develop high-quality mineral resources. With its 25,000 hectares of mining titles in Quebec and its 2,900 hectares in Arizona, Tarku Resources is well-positioned to capitalize on the positive momentum in the commodity sector.

Julien Davy,

President and CEO

Tarku Contact Information:

Email:

Website: www.tarkuresources.com

Please follow @TarkuResources on LinkedIn, Facebook, Twitter and Instagram and YouTube

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku’s periodic reports, including the annual report, or in the filings made by Tarku from time to time with securities regulatory authorities.