Tarku provides an update on its exploration activities on Admiral

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

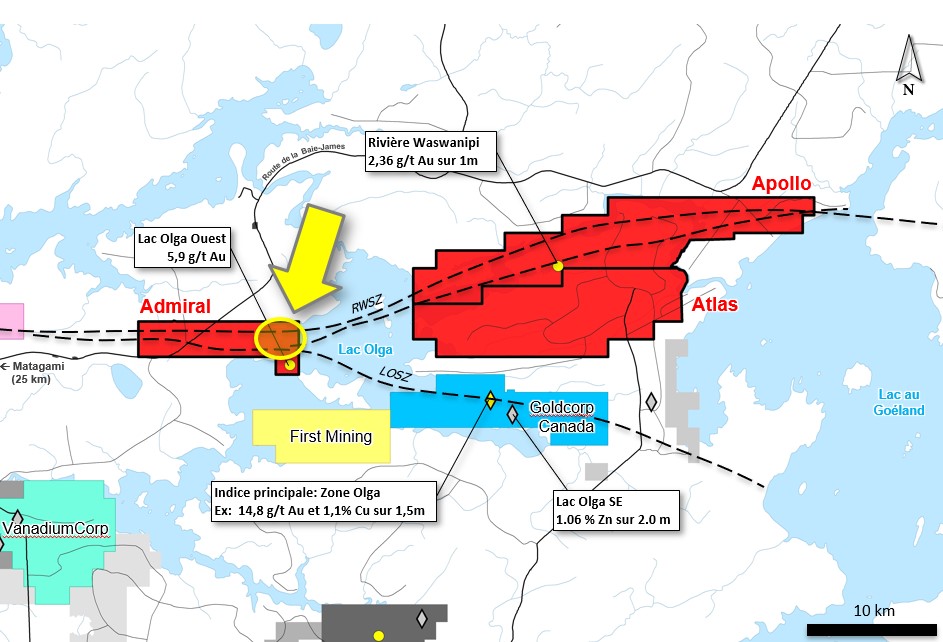

MONTREAL, June 06, 2019 - Tarku Resources Ltd. (TSX-V: TKU) (the "Company" or "Tarku") is pleased to provide an update on its exploration activities on its wholly owned Admiral Project, in the Matagami area, Eeyou Istchee James Bay, Quebec (see figure 1). Despite the fact that the samples did not return any economic gold results, the 5 drill holes demonstrated the presence of numerous elements consistent with the orogenic gold exploration model associated with alkaline rocks and porphyry intrusions (syenite-associated type). Next step will be to prospect other high potential gold targets on the Admiral and Apollo projects along the auriferous corridor that Tarku interprets as the extension of the Sunday Lake regional structure (see April 10, 2019 press release).

The objective of the drilling program was to test and understand the geological context of the eastern portion of the Admiral project along a 1 to 1.5 km wide corridor identified by Tarku’s previous high-resolution geophysical survey and data compilations (see November 29, 2018 press release). The structural corridor that contains the Lac Olga Ouest gold showing (5.9 g/t Au, grab sample, GM 49140) is a favourable setting for orogenic gold mineralization associated with alkaline rocks and porphyry intrusions (Figure 1).

A total of 796 meters was completed in 5 drill holes. Most of the holes intersected brittle-ductile faults zones injected by "syenitic and monzonitic" dykes. Albite-iron carbonate-hematite alterations with tourmaline-quartz-pyrite veinlets were notably observed in drill hole AD-19-03. The results allow the correlation of the anomalous presence of gold traces in association with syenitic dykes with albite-iron carbonate-hematite alteration. The summary of the surveys was presented in the March 26, 2019 press release (available at www.tarkuresources.com and www.sedar.com)

About the Admiral project

The Admiral project is part of 3 projects wholly owned by Tarku in the Matagami area (Admiral, Apollo and Atlas) totaling 224 mining titles centered on regional faults including ductile shear of the Waswanipi River (RWSZ), a favourable setting for orogenic gold mineralization associated with alkaline rocks and porphyry intrusions. Tarku interprets this geological context as being similar to the Sunday Lake regional fault, host of the Detour Lake Mine or the Kirkland Lake Mining Camp.

The Admiral project is located west of Lake Olga and consists of 30 claims (1,667 ha) overlying the convergence of the Rivière Waswanipi (RWSZ) and Lac Olga (LOSZ) shear zones. The LOSZ contains the Lac Olga Ouest gold showing (5.9 g/t Au, grab sample, GM 49140) and Goldcorp’s high-grade deposit Indice Principal zone Olga located 10 km southeast of Admiral (14.75 g/t Au, 1.14% Cu and 10.3 g/t Ag over 1.50 m, GM 50632) (see www.tarkuresources.com).

Tarku’s management believes that the gold potential of the Matagami sector has been undervalued and uses today modern geological models and exploration techniques to aid in the discovery of gold mineralization. Tarku cautions that the mineralization at the Detour Lake mine or the Kirkland Lake mining Camp may not be indicative of the mineralization that may be identified on the Company’s Matagami projects and is used as a conceptual exploration model only.

Benoit Lafrance, P.Geo., PhD, Exploration Manager and Director of Tarku, is the qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects who prepared, supervised and approved the technical information in this news release.

Drilling area location. The Admiral project is located at the convergence of the Rivière Waswanipi (RWSZ) and Lac Olga (LOSZ) shear zones (modified from Sigeom).

About Tarku Resources Ltd. (TSX-V: TKU)

Tarku is an exploration company focused on generating sustainable projects for precious, base and strategic metals by conducting exploration in areas with strong geologic potential and high levels of social acceptability. Project generation is the foundation of mining development, and Tarku’s vision is to generate exploration projects with excellent potential for mining development for prospective partners or buyers. Tarku has 76,148,797 outstanding shares, of which approximately 70% are owned by insiders and major shareholders. Management is currently reviewing several opportunities and projects to build up the Company portfolio and generate shareholder value.

For more information, please visit the Company’s web site or contact:

Julien Davy, President & CEO

+1 (514) 618-7287

www.tarkuresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku’s periodic reports including the annual report or in the filings made by Tarku from time to time with securities regulatory authorities.