Tarku Completes its maiden Drilling at Apollo and confirms the model

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

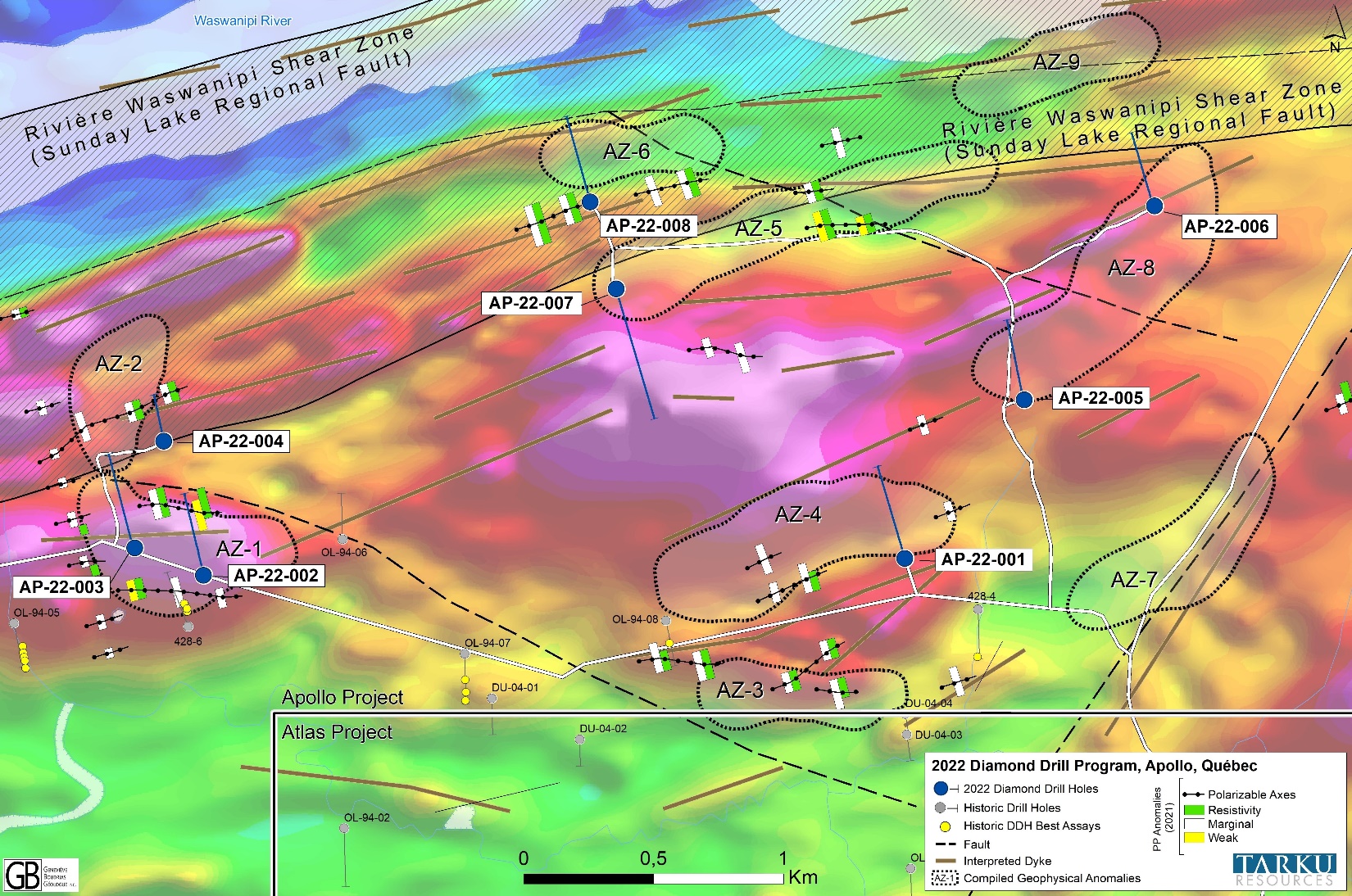

MONTREAL, December 22, 2022. Tarku Resources Ltd (TSX-V: TKU – FRA: 7TK – OTCQB: TRKUF) (the “Company” or “Tarku”) is pleased to announce the successful completion of the maiden drill program on it’s Apollo Gold Project, part of the 3As Projects, located east of the town of Matagami, Eeyou Istchee James Bay, Quebec. Eight holes, for a total of 3,048m were completed on a 4km wide priority area of the east extension of the Sunday Lake Fault. Tarku controls 100% of more than 20km length of the regional faults, where no exploration has ever been reported for gold. Assays are pending for all holes but are expected to be received during Q1 2023.

- Eight (8) holes, with lengths between 217m and 577m, totalling 3,048m were completed.

- From east to west, the area covers a 4km long section of the Sunday Lake Fault.

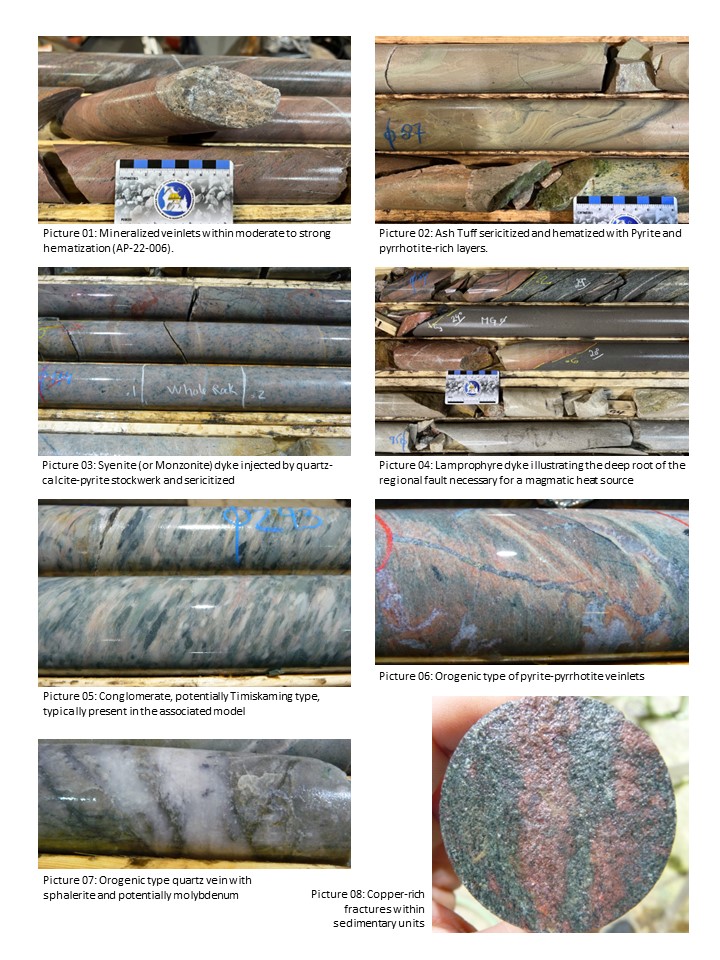

- Visual inspection of the core reveals both intensive hydrothermal alterations, similar in style to Orogenic Gold Deposits, as well as magmatic alteration including; hematization, carbonatization and sericitization.

- Fine grained disseminated pyrite, pyrrhotite, sphalerite and copper are observed over intervals up to 45 metres thick.

- The drill core has now been prepared and sent for assay, with results expected in the first quarter of 2023.

Julien Davy, President and CEO of Tarku Resources said: “We are very impressed by the core recovered during this maiden drill program. All 8 holes intersected prospective environments and the unexpected presence of visible base metals such as sphalerite and copper increase the prospectivity of this overlooked area. We’ll work on the interpretations during the coming weeks but the visible alterations halos of carbonatization, hematization, sericitization and silicification with structural control as visible breccia and the presence of long sequence of mineralization give us strong indications that this project looks more and more like other Abitibi-based multi-million ounces deposits. We eagerly await the assay results and wish all our shareholders and stakeholders a very Merry Christmas and a Happy New Year.”

Apollo Drill Program Summary (See release dated November 24, 2022, for holes 001 to 005):

- The Sixth Hole (AP-22-006, 325m depth) tested the eastern side of Zone 8 Target (AZ8), corresponding to a high-chargeability anomaly with a strong magnetic susceptibility. Hole 6 intersected strongly altered rocks with pervasive silicification altering with moderate to intense meter wide sections of hematization associated with disseminated to massive magnetite and up to 5% disseminated pyrite. The hole section is regularly crosscut by quartz-carbonate-anhydrite and pyrite veinlets and stockwork with epidote and fuschite associated with pyrite, chalcopyrite and pyrrhotite.

- The Seventh Hole (AP-22-008, 407m depth) tested the north area of the Zone 6 Target (AZ6) within the regional Sunday Lake Fault corresponding to structurally controlled geophysical responses. The hole intersected a different volcano-sedimentary environment within the regional Sunday Lake Fault with visible strong to intense deformation throughout the hole. The first 170 meters intersected well carbonated sequences of black shale and wacke with metre long sections of up to 10% pyrite and pyrrhotite. After the first 170 metres, lapillis tuffs have strong pervasive silicification and are intruded by quartz-carbonate veinlets that locally become stockwork with cm patches of pyrite, pyrrhotite and chalcopyrite. A decametric wide section showed visible copper with quartz-carbonate veinlets and several syenitic dykes are visible.

- The Eight Hole (AP-22-007, 577m depth) targeted the Zone 5 Target (AZ5) and the bottom of the main magnetic anomaly. The hole has similarities with hole AP-22-002 with same syenitic dykes and ash to lapillis tuffs with over 100m of pervasive carbonatization, silicification, and hematization associated with disseminated to massive magnetite. The hole intersected a 49 meters long section of up to 5% pyrite, and pyrrhotite, finely disseminated throughout the section with locally sphalerite and potentially molybdenum also described.

Location Map of 2022 drill program at the Apollo Project. Background is a geophysical compilation of MAG, IP and TDEM surveys completed between 2019 and 2022

Pictures of 2022 Apollo drill core demonstrating a mineralization environment typical of orogenix and magmatique systemes

Qualified persons

Julien Davy, P.Geo., M.Sc, MBA, President and Chief Executive Officer of Tarku, the qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, prepared, supervised and approved the technical information in this news release.

About Tarku Resources Ltd. (TSX.V: TKU – FRA: 7TK – OTCBQ: TRKUF)

Tarku is an exploration company focused on new discoveries in favourable mining jurisdictions such as Quebec and Arizona.

In Arizona, within the famous Tombstone District, Tarku owns 100% of the 29 km2 Silver Strike Project. Silver Strike has been interpreted by management to have the protentional for similar CRD Deposits comparable to the Hermosa Project, located 80km west in Santa Cruz County, Arizona, which South32 acquired for USD 1.8 billion in 2018. Tarku is currently planning a surface mapping program, a deep-penetrating and high-resolution geophysical survey over the priority targets, with a minimum of 5,000-meter drill program in the upcoming month.

In Quebec, Tarku owns 100% of the “Three A’s” exploration projects, (Apollo, Admiral and Atlas Projects), in the Matagami Greenstone Belt, which has been interpreted by management as the eastern extension of the Detour Belt. The Detour Belt has seen recent exploration successes by Midland Exploration Inc., Wallbridge Mining Company Ltd., Probe Metals Inc. After the last deep-penetration and high-definition IP geophysical survey over Apollo, Tarku has completed an over 3,000m drill program and is waiting for the results.

On behalf of Tarku Resources Ltd

Julien Davy,

President and CEO

Tarku Contact Information:

Email:

Website: www.tarkuresources.com

Please follow @TarkuResources on LinkedIn, Facebook, Twitter and Instagram.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku’s periodic reports including the annual report or in the filings made by Tarku from time to time with securities regulatory authorities.